Car Insurance Quote Progressive A Comprehensive Guide

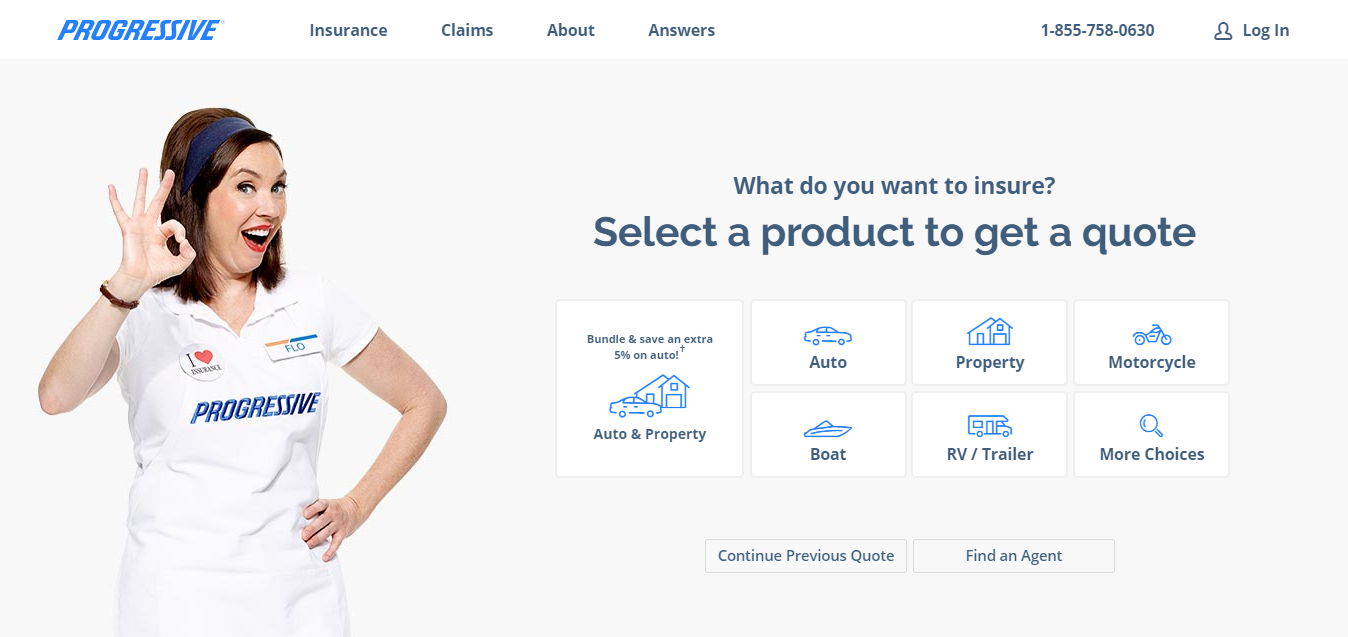

Car insurance quote Progressive offers a streamlined process for obtaining car insurance quotes. Understanding the factors influencing your quote, such as driving history and vehicle details, is crucial for securing the best possible rate. This guide explores Progressive’s quoting process, comparing it to competitors and examining the various coverage options and discounts available. We’ll also delve into customer reviews and the claims process, providing a holistic view of Progressive’s car insurance offerings.

From navigating the online tools and mobile app to understanding policy documents and utilizing customer service channels, we aim to equip you with the knowledge needed to make informed decisions about your car insurance needs. We will cover key aspects such as the impact of different coverage levels on your premium, and how to maximize savings through available discounts. By the end, you’ll have a clear picture of whether Progressive is the right insurer for you.

Factors Affecting Progressive Car Insurance Quotes

Several key factors influence the price of a Progressive car insurance quote. Understanding these factors can help you make informed decisions and potentially secure a more favorable rate. The insurer uses a complex algorithm considering various aspects of your profile and driving habits to determine your risk level and, consequently, your premium.

Driving History

Your driving history is a significant determinant of your Progressive car insurance quote. A clean driving record, free from accidents and traffic violations, generally results in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will substantially increase your rates. The severity and frequency of incidents play a crucial role. For example, a single minor fender bender might have a less dramatic impact than a serious accident involving injuries or property damage. Similarly, multiple speeding tickets within a short period will likely lead to a higher premium than a single isolated incident. Progressive, like other insurers, uses a points system to assess risk based on your driving record. More points translate to a higher risk profile and a more expensive premium.

Vehicle Type and Age, Car insurance quote progressive

The type and age of your vehicle are also important factors. Generally, newer cars are more expensive to repair, leading to higher insurance premiums. The make and model also play a role; some vehicles are statistically more prone to accidents or theft, resulting in higher insurance costs. For example, sports cars often command higher premiums than sedans due to their higher performance and increased risk of accidents. Older vehicles, while often less expensive to insure initially, might require more frequent repairs, potentially offsetting the initial savings. The safety features of your vehicle also influence the quote; cars equipped with advanced safety technology, such as anti-lock brakes and airbags, may qualify for discounts.

Coverage Options

The level of coverage you choose significantly impacts your premium. Basic liability coverage, which covers damages to others in an accident you cause, is typically the least expensive option. However, adding comprehensive and collision coverage, which protects your vehicle against damage from accidents or other events, will increase your premium. Similarly, opting for higher liability limits will also result in a higher cost. For example, choosing a $100,000 liability limit will be less expensive than a $500,000 limit. Uninsured/underinsured motorist coverage, which protects you if you’re involved in an accident with an uninsured driver, also adds to the overall cost but provides crucial financial protection. Therefore, choosing the right coverage balance between cost and protection is essential.

Customer Reviews and Ratings of Progressive: Car Insurance Quote Progressive

Progressive, a major player in the US car insurance market, receives a wide range of customer reviews and ratings across various online platforms like Google Reviews, Yelp, and the Better Business Bureau. Analyzing these reviews provides valuable insight into customer experiences and overall satisfaction with the company’s services. Understanding these perspectives is crucial for potential customers seeking a comprehensive picture of Progressive’s strengths and weaknesses.

A significant portion of customer feedback highlights both positive and negative aspects of their interactions with Progressive. These reviews are often categorized based on specific areas of the customer experience, allowing for a more nuanced understanding of customer sentiment.

Securing a competitive car insurance quote progressive is a priority for many drivers. To get a comprehensive comparison, it’s helpful to explore options beyond your initial search. For Pennsylvania residents, checking out resources like car insurance quote pa can offer valuable insights into local rates and coverage. Ultimately, comparing various quotes, including those from Progressive and Pennsylvania-specific providers, helps ensure you find the best car insurance quote progressive for your needs.

Positive Customer Feedback on Progressive

Positive reviews frequently praise Progressive’s competitive pricing, user-friendly online tools and mobile app, and the responsiveness of their customer service representatives. Many customers appreciate the ease of obtaining quotes and managing their policies online, finding the digital experience streamlined and efficient. The availability of various discounts, such as those for bundling policies or maintaining a good driving record, is another recurring theme in positive reviews. Examples of positive comments include praise for quick claims processing and the helpfulness of claims adjusters in resolving issues efficiently.

Negative Customer Feedback on Progressive

Conversely, negative reviews often focus on issues with claims processing, particularly lengthy wait times or difficulties in reaching representatives. Some customers report feeling frustrated by unexpected increases in premiums or difficulties understanding policy details. While the online tools are generally well-regarded, some users have experienced technical glitches or found the navigation cumbersome. Negative feedback also sometimes points to a lack of personalized service, with some customers feeling like they are just a number in a large system.

Overall Customer Satisfaction with Progressive

Overall customer satisfaction with Progressive appears to be mixed. While many customers appreciate the company’s competitive pricing and convenient online tools, others express frustration with claims processing delays and a perceived lack of personalized attention. The overall rating tends to fluctuate depending on the platform and the specific aspects of the service being reviewed. For instance, a high rating on ease of online quote acquisition might be counterbalanced by lower ratings on claim handling efficiency. This suggests that Progressive excels in certain areas while needing improvement in others to achieve consistently high levels of customer satisfaction.

Comparison with Other Major Insurers

Choosing car insurance can feel overwhelming, with numerous companies offering various coverage options and price points. To help you make an informed decision, we’ll compare Progressive’s offerings with those of two other major insurers: State Farm and Geico. This comparison will focus on rates and coverage, highlighting key differences to aid your understanding. Remember that individual quotes will vary based on factors like driving history, location, and vehicle type.

Progressive, State Farm, and Geico are among the largest car insurance providers in the United States, each with its own strengths and weaknesses. A direct comparison allows for a clearer picture of which insurer might best suit your individual needs and budget. It’s crucial to obtain personalized quotes from each company to determine the most cost-effective option for your specific circumstances.

Rate and Coverage Comparison

The following table provides a general comparison of rates and coverage options. Please note that these are illustrative examples and actual quotes will vary significantly depending on individual circumstances. It is essential to obtain personalized quotes from each insurer for accurate pricing and coverage details.

| Feature | Progressive | State Farm | Geico |

|---|---|---|---|

| Liability Coverage (100/300/100) | $500 – $800 (estimated) | $450 – $750 (estimated) | $400 – $700 (estimated) |

| Collision Coverage (deductible $500) | $200 – $400 (estimated) | $180 – $350 (estimated) | $150 – $300 (estimated) |

| Comprehensive Coverage (deductible $500) | $150 – $300 (estimated) | $130 – $280 (estimated) | $120 – $250 (estimated) |

| Uninsured/Underinsured Motorist Coverage | Available, varying limits | Available, varying limits | Available, varying limits |

| Discounts Offered | Multiple discounts available (e.g., good driver, multi-policy, safe driver) | Multiple discounts available (e.g., good driver, multi-policy, defensive driving) | Multiple discounts available (e.g., good driver, multi-policy, bundling) |

Understanding Progressive’s Policy Documents

Your Progressive car insurance policy is a legally binding contract outlining your coverage, responsibilities, and the insurer’s obligations. Understanding its contents is crucial to ensuring you’re adequately protected and aware of your rights. Failing to understand your policy could lead to unexpected costs or gaps in coverage during a claim.

Understanding the key sections and terms within your policy will empower you to make informed decisions about your insurance needs and effectively navigate any claims process. This knowledge also helps prevent misunderstandings and disputes with the insurance company.

Policy Declarations Page

The declarations page is the summary of your policy. It provides essential information such as your name, address, policy number, vehicle information (make, model, year), coverage types (liability, collision, comprehensive, etc.), coverage limits, premium amount, and policy effective and expiration dates. This page acts as a quick reference guide to your policy’s key details. It’s the first place to look for basic information about your insurance coverage.

Coverage Sections

This section details the specific types of coverage you’ve purchased. Each coverage type (liability, collision, comprehensive, uninsured/underinsured motorist, etc.) will have its own subsection explaining what it covers, the limits of coverage, and any conditions or exclusions that apply. For example, the liability section would Artikel your coverage for bodily injury and property damage caused to others in an accident you’re at fault for. The collision coverage section would detail the coverage for damage to your vehicle resulting from a collision, regardless of fault.

Exclusions and Limitations

This is a critically important section. It specifies what events or circumstances are *not* covered by your policy. Common exclusions might include damage caused by wear and tear, intentional acts, or driving under the influence of alcohol or drugs. Limitations might specify deductibles (the amount you pay out-of-pocket before your coverage kicks in) or specific limits on coverage amounts for certain types of losses. For instance, your policy might exclude coverage for damage caused by flood if you haven’t purchased separate flood insurance. Understanding these limitations is vital to avoid unpleasant surprises during a claim. For example, a policy might limit liability coverage to a specific dollar amount, meaning you would be personally responsible for any damages exceeding that limit.

Conditions and Duties After an Accident

This section Artikels your responsibilities following an accident. This typically includes promptly notifying Progressive of the accident, cooperating with their investigation, and providing necessary documentation. Failure to comply with these conditions could jeopardize your claim. For example, you might be required to provide a police report or witness statements. Ignoring these requirements could lead to denial of your claim.

Definitions

This section defines key terms used throughout the policy, ensuring clarity and consistency in interpretation. Understanding these definitions is essential for a correct understanding of your coverage. For instance, the definition of “accident” might be crucial in determining whether a particular event is covered under your policy.

Securing affordable and comprehensive car insurance is a vital aspect of responsible car ownership. This guide has provided a detailed exploration of Progressive’s car insurance offerings, from obtaining a quote to filing a claim. By understanding the factors that influence your quote, exploring available coverage options, and utilizing Progressive’s resources, you can make an informed decision that best suits your individual needs and budget. Remember to compare Progressive’s offerings with other insurers to ensure you’re getting the best value for your money.

Securing a competitive car insurance quote progressive is a priority for many drivers. When comparing rates, it’s beneficial to explore other options, such as checking out a triple a car insurance quote to see how their coverage and pricing stack up. Ultimately, understanding various quotes allows you to make the most informed decision for your car insurance needs with Progressive or another provider.

Post a Comment