Car Insurance Quotes Arkansas Find the Best Deal

Car insurance quotes Arkansas: Navigating the complexities of finding affordable and comprehensive car insurance in Arkansas can feel overwhelming. This guide simplifies the process, providing insights into the state’s insurance market, key factors influencing your premiums, and strategies for securing the best possible coverage at the most competitive price. We’ll explore the various types of coverage available, discuss common discounts, and offer tips for avoiding costly mistakes.

Understanding the Arkansas car insurance landscape is crucial for making informed decisions. From comparing major providers and understanding the regulatory environment to mastering the art of negotiating lower premiums, we aim to equip you with the knowledge and tools necessary to confidently navigate this important aspect of car ownership.

Arkansas Car Insurance Market Overview

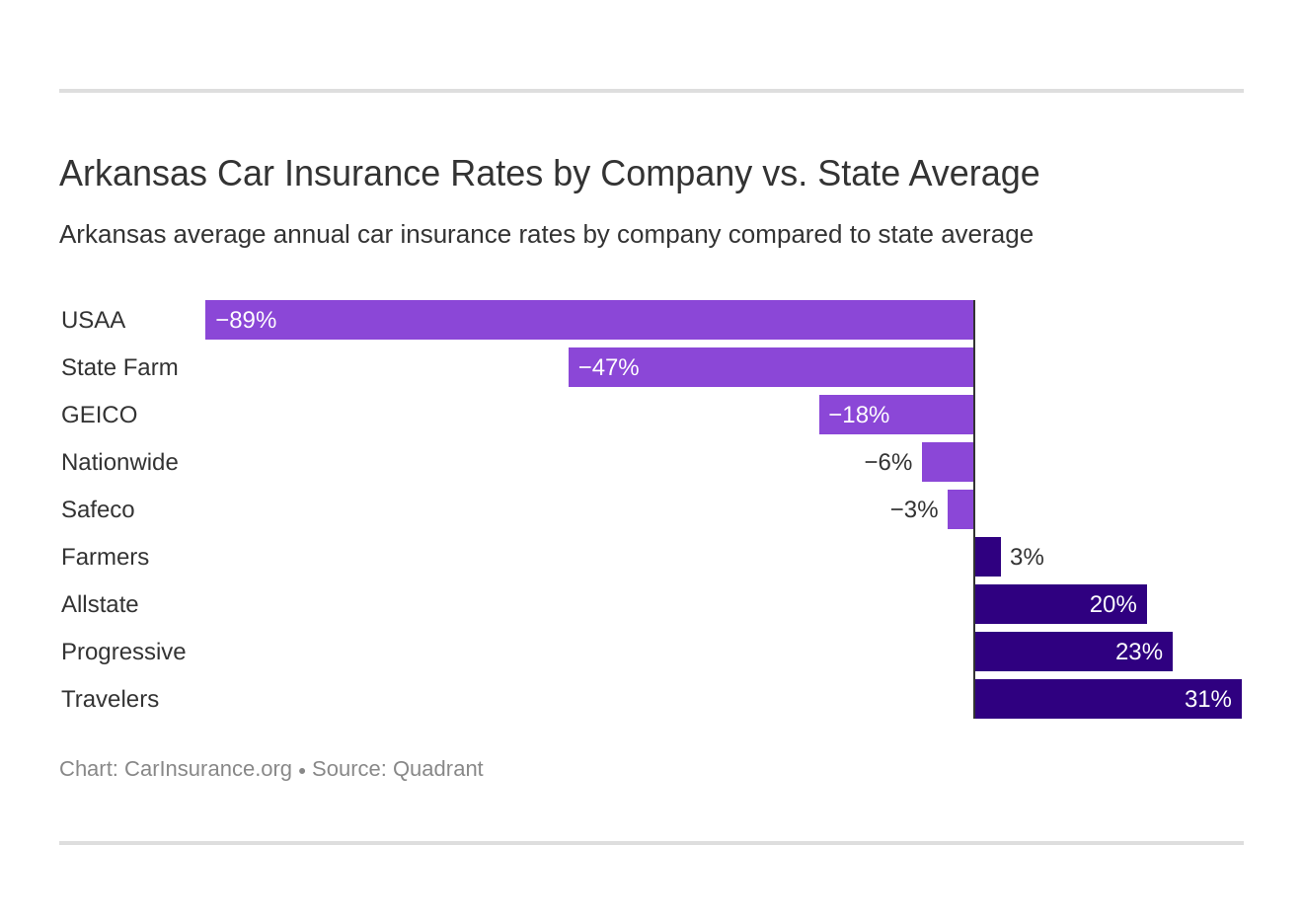

The Arkansas car insurance market is a blend of national and regional players, creating a moderately competitive landscape. While large national insurers dominate market share, several smaller, regional companies also offer policies, providing consumers with a range of choices and price points. Understanding the market dynamics is crucial for Arkansas residents seeking the best car insurance coverage at the most affordable rates.

The competitive nature of the market leads to varying levels of service and pricing strategies. Consumers should compare quotes from multiple insurers to find the most suitable option for their needs and budget.

Major Insurance Providers in Arkansas

Several major insurance providers operate extensively within Arkansas, offering a variety of coverage options. These include national giants such as State Farm, Geico, Progressive, and Allstate, alongside regional and smaller insurers who may focus on specific demographics or risk profiles. The presence of both large and small insurers fosters competition, potentially leading to more competitive pricing and a wider array of policy options for consumers. However, the dominance of larger national players might also limit the negotiation power of individual consumers in some instances.

Types of Car Insurance Coverage in Arkansas

Arkansas, like other states, mandates specific minimum levels of car insurance coverage. These minimums typically include bodily injury liability and property damage liability. Beyond these minimums, drivers can opt for additional coverage such as collision, comprehensive, uninsured/underinsured motorist (UM/UIM), and medical payments coverage. Collision coverage pays for repairs to your vehicle following an accident, regardless of fault, while comprehensive coverage protects against damage caused by events other than collisions, such as theft, vandalism, or hail. UM/UIM coverage protects you if you’re involved in an accident with an uninsured or underinsured driver, and medical payments coverage helps cover medical expenses for you and your passengers, regardless of fault. The choice of coverage levels is a personal decision, balancing the need for protection with the cost of premiums.

Regulatory Environment Governing Car Insurance in Arkansas

The Arkansas Department of Insurance regulates the car insurance market within the state. This regulatory body sets minimum coverage requirements, oversees insurer solvency, and investigates consumer complaints. Their role is to ensure fair and competitive practices within the industry, protecting consumers from unfair pricing or inadequate coverage. The department’s website serves as a valuable resource for consumers seeking information on insurers, filing complaints, or understanding their rights and responsibilities regarding car insurance. The regulatory framework aims to balance the needs of consumers with the financial stability of the insurance industry.

Discounts and Savings on Arkansas Car Insurance: Car Insurance Quotes Arkansas

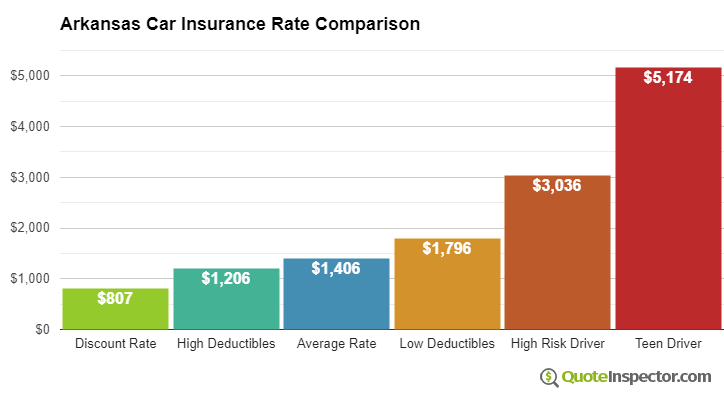

Securing affordable car insurance in Arkansas is achievable through various discounts and savings strategies. Understanding these options can significantly reduce your premiums and make insurance more manageable. Many factors influence your rate, and taking advantage of available discounts can lead to substantial savings over time.

Common Discounts Offered by Arkansas Car Insurance Providers, Car insurance quotes arkansas

Numerous discounts are commonly offered by Arkansas car insurance companies. These discounts incentivize safe driving habits, financial responsibility, and bundling insurance policies. Taking advantage of multiple discounts can result in a considerable reduction in your overall premium.

- Safe Driver Discount: This is perhaps the most common discount, rewarding drivers with clean driving records. Specific requirements vary by insurer, but generally involve a certain number of years without accidents or traffic violations.

- Good Student Discount: Students maintaining a high grade point average (GPA) often qualify for this discount, reflecting the reduced risk associated with responsible, academically focused individuals.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course demonstrates a commitment to safe driving and can earn you a discount.

- Multiple Car Discount: Insuring multiple vehicles under one policy with the same provider often results in a discount on each vehicle’s premium.

- Bundling Discount: Combining your car insurance with other types of insurance, such as homeowners or renters insurance, typically leads to significant savings.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms or tracking systems, can lower your premiums as it reduces the risk of theft.

- Payment Plan Discount: Paying your premium in full annually may result in a discount compared to paying in installments.

Qualifying for Safe Driver Discounts

Safe driver discounts are a significant way to lower your car insurance costs. Insurance companies assess risk based on your driving history. Maintaining a clean driving record, free from accidents and traffic violations, is key to qualifying for and maintaining these discounts. The length of time required for eligibility varies between insurance providers, but generally, a longer period without incidents leads to greater discounts. Some companies may also consider factors such as the severity of any past accidents or violations. For example, a minor fender bender might have less impact than a serious accident with injuries.

Benefits of Bundling Car Insurance with Other Types of Insurance

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, is a strategic way to save money. Insurance companies often offer discounts for bundling because it simplifies their administration and increases customer loyalty. The specific discount amount varies depending on the insurer and the types of policies bundled. This approach often leads to a more significant reduction in premiums than any single discount could offer. For example, bundling car and home insurance might result in a 10-15% discount or more on both policies.

Tips for Negotiating Lower Premiums

Negotiating lower premiums involves proactive engagement with your insurance provider. Comparing quotes from multiple companies is crucial to determine the best rates. Highlighting your clean driving record and any relevant discounts you qualify for strengthens your negotiating position. Consider increasing your deductible to lower your premium; however, weigh this against your financial capacity to cover a higher out-of-pocket expense in the event of an accident. Finally, be prepared to switch providers if your current insurer is unwilling to offer competitive rates.

Common Car Insurance Mistakes to Avoid

Purchasing car insurance in Arkansas, or anywhere for that matter, can seem straightforward, but many common pitfalls can lead to inadequate coverage or unnecessary expenses. Understanding these mistakes and taking preventative measures can save you significant time, money, and frustration in the long run. This section highlights several key areas where many policyholders stumble.

Failing to maintain adequate coverage carries several serious consequences. The most significant is the potential for substantial out-of-pocket expenses in the event of an accident. Without sufficient liability coverage, you could be personally responsible for paying for the other driver’s medical bills and vehicle repairs, potentially leading to financial ruin. Similarly, insufficient uninsured/underinsured motorist coverage leaves you vulnerable if you’re involved in a collision with a driver who lacks adequate insurance or is uninsured altogether. Comprehensive and collision coverage protect your own vehicle, and inadequate limits here can leave you shouldering significant repair costs or replacement costs.

Insufficient Liability Coverage

Liability insurance covers the costs associated with injuries or damages you cause to others in an accident. Choosing minimum liability limits, while tempting to lower premiums, exposes you to considerable risk. In Arkansas, the minimum liability coverage may not be sufficient to cover the costs of serious injuries or extensive property damage. A higher liability limit provides greater protection and peace of mind, knowing you’re adequately covered in case of a serious accident. For example, an accident resulting in significant medical bills for multiple injured parties could easily exceed the minimum liability limits, leaving you personally liable for the difference.

Ignoring Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident caused by a driver without adequate insurance or who is uninsured. Many drivers underestimate the prevalence of uninsured drivers on the road. Choosing to forgo UM/UIM coverage or selecting low limits leaves you vulnerable to significant financial losses if you’re injured by an uninsured driver. This coverage is particularly crucial in areas with higher rates of uninsured drivers. A strong UM/UIM policy can ensure your medical expenses and lost wages are covered even if the at-fault driver is uninsured.

Failing to Read the Policy Carefully

Carefully reviewing your insurance policy is crucial. Many people simply accept the policy without thoroughly understanding its terms and conditions. This can lead to misunderstandings about coverage limits, exclusions, and other important details. Take the time to read your policy thoroughly, or ask your insurance agent to explain any confusing aspects. Understanding your policy ensures you know exactly what’s covered and what’s not. Ignoring this step can result in disputes later when you need to file a claim and discover a gap in coverage you were unaware of.

Falling Prey to Insurance Scams

Be wary of unsolicited offers for car insurance that seem too good to be true. These offers are often associated with scams that aim to steal your personal information or money. Legitimate insurance companies rarely solicit business through unsolicited phone calls or emails. Always verify the legitimacy of any insurance company or agent before providing any personal information. If an offer seems suspicious, contact your state’s insurance department to verify its authenticity. Additionally, be cautious of companies that pressure you into purchasing a policy immediately without giving you time to compare options.

Securing the right car insurance in Arkansas involves careful consideration of your individual needs and risk profile. By understanding the factors that influence premiums, actively comparing quotes, and leveraging available discounts, you can significantly reduce your insurance costs without compromising on essential coverage. Remember, proactive research and informed decision-making are key to finding the perfect balance between affordability and comprehensive protection.

Securing affordable car insurance quotes in Arkansas involves comparing rates from multiple providers. It’s helpful to understand how rates vary geographically; for instance, the process for obtaining ny car insurance quotes might differ significantly. Understanding these differences can inform your approach to finding the best car insurance quotes in Arkansas, ensuring you’re getting the most competitive price for your needs.

Securing affordable car insurance quotes in Arkansas can sometimes feel overwhelming. Fortunately, the process is simplified by readily available online tools; you can easily compare rates by going to a site like get car insurance quote online to find the best coverage for your needs. This allows you to focus on finding the right car insurance quotes in Arkansas without unnecessary hassle.

Post a Comment