Illinois Car Insurance Quote Your Guide

Illinois car insurance quote is more than just a number; it’s a reflection of your driving history, vehicle, and location. Understanding how these factors influence your premium is crucial to securing affordable and comprehensive coverage. This guide navigates the complexities of the Illinois car insurance market, providing insights into finding the best quote and ensuring you’re adequately protected on the road.

From comparing major insurance providers and understanding coverage types to leveraging discounts and navigating the claims process, we demystify the intricacies of Illinois car insurance. We’ll explore the impact of driving violations on your rates and offer practical tips to keep your premiums low. Ultimately, this guide empowers you to make informed decisions about your car insurance needs in Illinois.

Factors Affecting Illinois Car Insurance Quotes

Several key factors influence the cost of car insurance in Illinois. Understanding these factors can help you make informed decisions and potentially save money on your premiums. These factors interact in complex ways, so your final quote will be a unique reflection of your individual circumstances.

Driving History

Your driving history significantly impacts your Illinois car insurance premiums. Insurance companies assess risk based on your past driving record. A clean driving record, free of accidents and traffic violations, will typically result in lower premiums. Conversely, accidents, particularly those resulting in injuries or significant property damage, will likely lead to higher premiums. The severity and frequency of incidents are crucial factors. For example, a single minor fender bender might have a less substantial impact than multiple speeding tickets or a DUI conviction. Insurance companies often use a points system to track violations, and accumulating points can significantly increase your rates. Furthermore, the length of time since your last incident also plays a role; more recent incidents carry more weight than those from several years ago.

Age and Gender

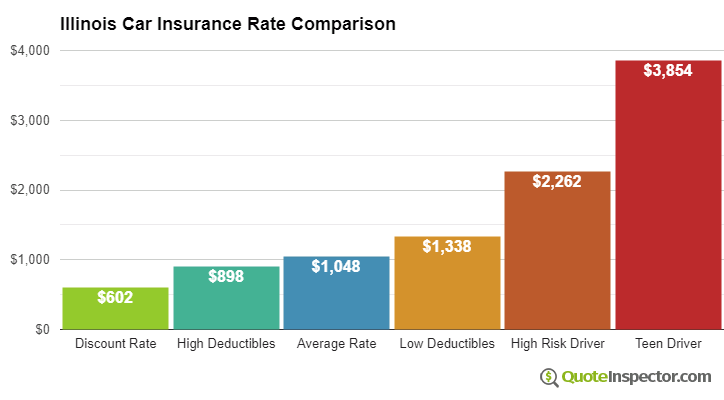

Age and gender are statistically correlated with accident risk, influencing insurance rates. Younger drivers, particularly those under 25, generally pay higher premiums due to their higher accident rate. This is because statistically, younger drivers have less experience and are more likely to be involved in accidents. As drivers age and gain experience, their premiums typically decrease. Gender can also play a role, though the impact varies between insurers and over time. Historically, male drivers in certain age ranges have faced higher rates than female drivers, reflecting statistical differences in accident rates. However, this gap is narrowing in many jurisdictions, as insurance companies refine their risk assessment models.

Vehicle Type and Value

The type and value of your vehicle are significant determinants of your insurance costs. More expensive cars generally cost more to insure because repairs and replacements are more costly. The vehicle’s safety features also play a role; cars with advanced safety technology like anti-lock brakes and airbags may qualify for discounts. The type of vehicle also matters; sports cars and high-performance vehicles often attract higher premiums due to their increased risk of accidents and higher repair costs. Conversely, smaller, less expensive vehicles typically have lower insurance premiums.

Location (City/County)

Your location in Illinois significantly impacts your car insurance rates. Insurance companies analyze accident rates, crime statistics, and other factors within specific geographic areas to assess risk. Areas with higher crime rates and more frequent accidents tend to have higher insurance premiums. For example, drivers in densely populated urban areas might pay more than those in rural communities due to increased traffic congestion and the higher probability of accidents. The specific city and county you reside in are key factors in determining your insurance quote.

Finding the Best Illinois Car Insurance Quote

Securing the most affordable and comprehensive car insurance in Illinois requires a strategic approach. By understanding the process and utilizing available resources, you can significantly reduce your premiums and ensure you have the right coverage. This involves careful comparison shopping and a thorough understanding of your own needs.

Obtaining the best car insurance quote involves a systematic process. It’s not simply about getting the lowest price; it’s about finding the best balance between cost and coverage. This guide Artikels the steps to effectively navigate the Illinois car insurance market.

Securing affordable Illinois car insurance quotes can be challenging, requiring careful comparison of different providers. If you’re considering options outside Illinois, you might explore companies like NJM, and check out their rates with a quick visit to their quote page: njm car insurance quote. Ultimately, the best Illinois car insurance quote will depend on your individual needs and driving history.

A Step-by-Step Guide to Obtaining Car Insurance Quotes in Illinois

- Gather Necessary Information: Before you begin, collect all the relevant details about yourself and your vehicle. This includes your driver’s license number, vehicle identification number (VIN), driving history (including accidents and violations), and the details of your vehicle (make, model, year). Accurate information is crucial for receiving accurate quotes.

- Use Online Comparison Tools: Many websites allow you to compare quotes from multiple insurers simultaneously. These tools simplify the process by allowing you to input your information once and receive multiple quotes. Remember to carefully review the coverage details of each quote, as prices can vary significantly.

- Contact Insurance Companies Directly: While comparison websites are helpful, contacting insurance companies directly can provide a more personalized experience. This allows you to ask specific questions and clarify any doubts you may have about coverage options.

- Compare Quotes Carefully: Once you have gathered several quotes, compare them side-by-side. Pay close attention not only to the price but also to the coverage details. A lower premium might come with limited coverage, leaving you vulnerable in case of an accident. Ensure the coverage limits are sufficient for your needs.

- Review Policy Details: Before committing to a policy, carefully read the policy documents to understand the terms and conditions. Pay particular attention to deductibles, coverage limits, and exclusions.

- Consider Bundling: Many insurers offer discounts for bundling car insurance with other types of insurance, such as homeowners or renters insurance. Explore this option to potentially reduce your overall costs.

Resources for Comparing Illinois Car Insurance Quotes

Several resources can assist you in comparing insurance quotes effectively. Using a combination of these resources can ensure you’re making an informed decision.

Securing affordable Illinois car insurance quotes can be challenging, requiring careful comparison of various providers. If you’re looking for options beyond the usual suspects, consider checking out an amica car insurance quote to see how their rates compare. Ultimately, the best Illinois car insurance quote will depend on your individual driving history and coverage needs.

- Online Comparison Websites: Websites such as The Zebra, NerdWallet, and Insurify allow you to compare quotes from multiple insurers at once. These sites often provide detailed information about coverage options and policy features.

- Independent Insurance Agents: Independent agents work with multiple insurance companies, giving you access to a broader range of options. They can help you navigate the complexities of insurance and find a policy that best suits your needs. They often provide personalized advice and can assist with claims.

- Directly Contacting Insurance Companies: Contacting insurance companies directly allows for a more in-depth discussion about your specific needs and coverage options. This approach is particularly useful if you have a complex insurance situation or require specialized coverage.

Illinois Car Insurance Regulations

Navigating the world of car insurance in Illinois requires understanding the state’s specific regulations. These rules are designed to protect both drivers and those affected by accidents, ensuring a minimum level of financial responsibility on the roads. Compliance is mandatory, and failure to do so can result in significant penalties.

Illinois mandates that all drivers carry a minimum level of liability insurance. This means you’re legally required to have coverage to pay for damages or injuries you cause to others in an accident. The specifics of this minimum coverage are clearly defined and must be adhered to.

Minimum Liability Coverage Requirements

Illinois’ minimum liability insurance requirements are designed to provide a safety net for those injured or whose property is damaged in accidents caused by uninsured or underinsured drivers. These minimums, however, may not be sufficient to cover all potential damages in serious accidents. It is strongly recommended that drivers consider purchasing higher liability limits for enhanced protection.

The state mandates a minimum of $25,000 of bodily injury liability coverage per person, and $50,000 per accident. This means that if you cause an accident resulting in injuries to multiple people, the maximum amount your insurance company will pay out for all injuries in that single accident is $50,000. Additionally, Illinois requires a minimum of $20,000 in property damage liability coverage. This covers the cost of repairing or replacing damaged property, such as another vehicle or a fence, resulting from your accident. These are the absolute minimums, and purchasing higher limits offers considerably greater financial protection.

Minimum Liability Coverage: $25,000 Bodily Injury per Person, $50,000 Bodily Injury per Accident, $20,000 Property Damage

Understanding Policy Documents

Your Illinois car insurance policy is a legally binding contract outlining the terms and conditions of your coverage. Understanding its contents is crucial to ensuring you have the protection you need and to avoid unexpected costs or disputes with your insurer. A thorough review will empower you to make informed decisions about your coverage and ensure you’re adequately protected.

Understanding the key sections of your policy will help you navigate potential claims and understand your rights and responsibilities. Failing to review your policy could lead to misunderstandings about coverage limits, deductibles, or exclusions, potentially leaving you financially vulnerable in the event of an accident.

Policy Declarations Page

This page summarizes the key information about your policy, acting as a quick reference guide. It includes your name, address, policy number, the covered vehicles, the coverage types (liability, collision, comprehensive, etc.), the policy period, and the premium amount. It also lists the named insured and any additional drivers covered under the policy. This page is the first place to look for basic information about your coverage.

Coverage Sections

This section details the specific types of coverage you purchased and the extent of that coverage. Each coverage type (liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, etc.) will have its own subsection outlining its limits, exclusions, and conditions. For example, the liability section will specify the limits of bodily injury and property damage coverage. The collision section will describe the coverage for damage to your vehicle in an accident, regardless of fault. Careful review of these sections ensures you understand what is and isn’t covered under your policy.

Exclusions and Limitations

This crucial section identifies situations or events not covered by your policy. Common exclusions might include damage caused by wear and tear, intentional acts, or driving under the influence. Understanding these limitations is essential to avoid misunderstandings and ensure you don’t expect coverage for situations explicitly excluded. For example, damage to your car from a flood might not be covered under a standard collision policy unless you’ve purchased additional flood coverage.

Definitions, Illinois car insurance quote

Many insurance policies contain a section defining key terms used throughout the document. This section clarifies the meaning of specific words or phrases, ensuring consistent interpretation of the policy’s terms. Familiarizing yourself with these definitions can prevent confusion and ensure you understand the scope of your coverage.

Conditions

This section Artikels the responsibilities of both the insured and the insurance company. It might include details on how to file a claim, the process for notifying the insurer of an accident, and your duties after an accident. Adhering to these conditions is crucial for maintaining the validity of your policy and ensuring a smooth claims process. For example, failing to notify your insurer of an accident promptly could affect your ability to file a claim.

Securing the right Illinois car insurance quote involves careful consideration of various factors and a proactive approach to finding the best coverage at the most competitive price. By understanding the nuances of the Illinois insurance market, utilizing available resources, and maintaining a safe driving record, you can significantly reduce your premiums and ensure peace of mind on the road. Remember to regularly review your policy and take advantage of available discounts to optimize your coverage.

Post a Comment