Car Insurance Quote Farmers A Comprehensive Guide

Car insurance quote farmers represent a significant aspect of securing affordable and comprehensive vehicle protection. Understanding the intricacies of obtaining a quote, the factors influencing its price, and the available coverage options is crucial for making informed decisions. This guide delves into the process of obtaining a Farmers car insurance quote, exploring various methods, influencing factors, and comparing it to competitors, ultimately empowering you to secure the best possible coverage.

Navigating the world of car insurance can be daunting, but with a clear understanding of the process and the available options, you can find the right coverage at the right price. This guide aims to provide that clarity, offering a comprehensive overview of Farmers Insurance, its quote acquisition methods, and the factors influencing the final cost. We’ll explore different coverage options, potential discounts, and compare Farmers with other major insurers to help you make an informed decision.

Farmers Insurance Quote Overview: Car Insurance Quote Farmers

Farmers Insurance is one of the largest U.S. insurance providers, offering a wide range of products, including car insurance. They are known for their extensive agent network, providing personalized service and potentially more convenient access to agents compared to solely online insurers. However, this personalized approach might mean slightly less competitive pricing in some instances compared to purely online options. Their car insurance offerings cover various needs, from basic liability to comprehensive coverage with additional features.

Farmers’ car insurance quotes are determined by a number of factors, reflecting a standard industry practice. These factors are used to assess risk and ultimately determine the premium. Understanding these factors can help consumers prepare for a more accurate quote and potentially negotiate better terms.

Factors Influencing Farmers Car Insurance Quotes

Several key factors influence the cost of your Farmers car insurance quote. These include your driving history (accidents, tickets, and years of driving experience), your vehicle’s make, model, and year (affecting repair costs and theft risk), your location (reflecting crime rates and accident frequency), your age and gender (statistical risk factors), and the coverage level you select (higher coverage levels naturally cost more). Additionally, your credit score can also be a factor, as it’s often used to predict future claims behavior, though this practice varies by state. For example, a driver with a clean driving record, a newer, safer car, living in a low-risk area, and choosing a minimum liability coverage will likely receive a lower quote than a driver with multiple accidents, an older vehicle, living in a high-crime area, and opting for comprehensive coverage with high liability limits.

Comparison of Farmers’ Quote Process with Other Major Insurers

Farmers’ quote process generally involves interacting with an agent, either in person, over the phone, or online through their website. This contrasts with some purely online insurers, such as Geico or Progressive, which primarily use online quote tools and have less emphasis on in-person agent interaction. While Farmers’ agent-based approach offers personalized service and potentially more detailed explanations, it might be perceived as less efficient than the streamlined online quote systems of competitors. Other insurers like State Farm also use a blend of online and agent-based approaches, offering varying levels of personalization and convenience. The best approach depends on individual preferences; some prefer the personal touch of an agent, while others value the speed and convenience of online quotes. The actual cost of the insurance, however, will vary depending on the individual’s risk profile and chosen coverage, irrespective of the insurer’s quote process.

Quote Acquisition Methods

Getting a car insurance quote from Farmers is straightforward, offering flexibility to suit various preferences. You can obtain a quote through their website, by phone, or by working directly with a local Farmers agent. Each method presents a different user experience, impacting speed, convenience, and the level of personalized assistance received.

Farmers offers several ways to acquire a car insurance quote, each with its own advantages and disadvantages. Understanding these differences can help you choose the best method for your needs and preferences. The choice depends on your comfort level with technology, your desire for personalized service, and the amount of time you’re willing to invest.

Obtaining a Quote via the Farmers Website

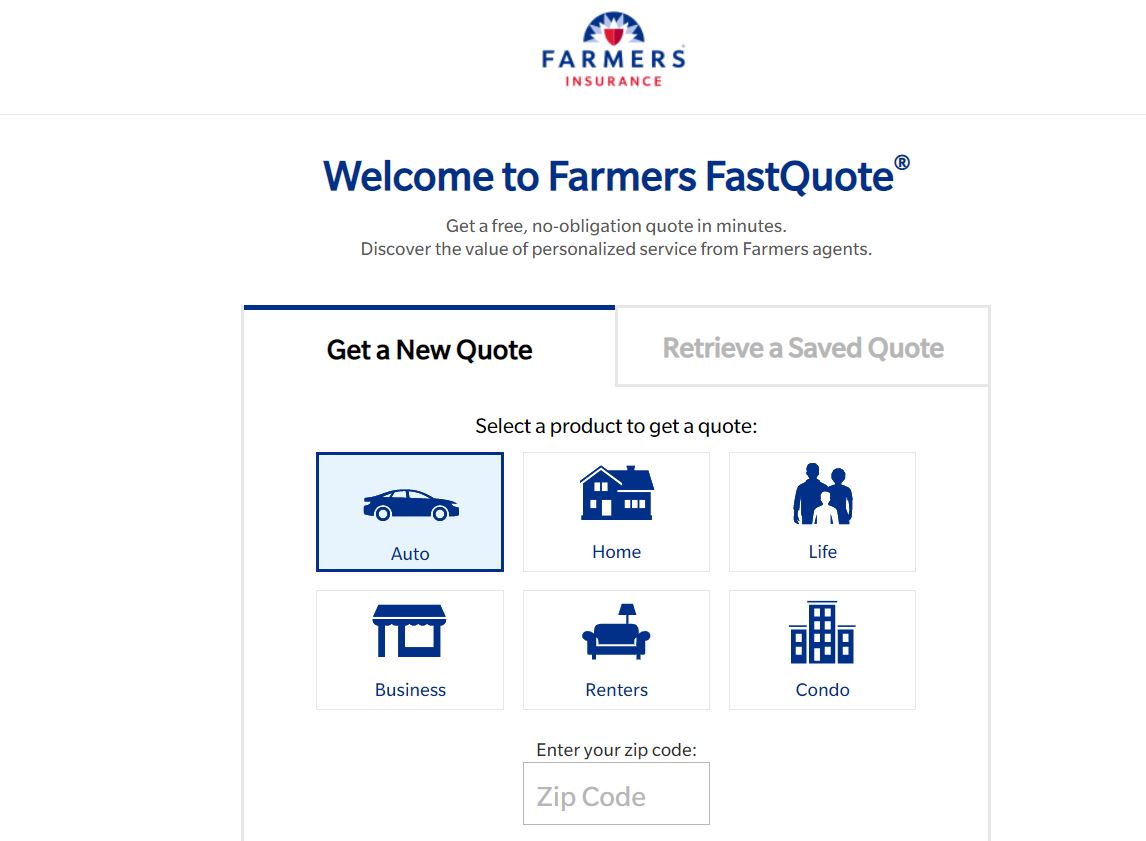

The Farmers website provides a user-friendly online quoting system. This method is generally the quickest and most convenient, allowing you to obtain a quote at your own pace, 24/7. The process involves providing essential vehicle and driver information, and the system will then generate a customized quote.

- Navigate to the Farmers Insurance website: Begin by visiting the official Farmers Insurance website. You’ll typically find a prominent “Get a Quote” button on the homepage.

- Select “Car Insurance”: Once on the site, select the “Car Insurance” option to initiate the quoting process. This will typically lead you to a form or questionnaire.

- Enter Vehicle Information: You’ll be asked to provide details about your vehicle(s), including the year, make, model, and VIN (Vehicle Identification Number). Accurate information is crucial for an accurate quote.

- Provide Driver Information: Next, you’ll need to input information about all drivers who will be using the vehicle(s), including their age, driving history, and license details. This section might include questions about accidents or traffic violations.

- Select Coverage Options: Farmers will offer various coverage options. Carefully review each option and select the level of coverage that best suits your needs and budget. Understanding the different coverage types (liability, collision, comprehensive, etc.) is essential.

- Review and Submit: Once you’ve completed all the necessary fields, review your information carefully for accuracy. After confirming everything is correct, submit your request. The system will then generate your personalized car insurance quote.

Obtaining a Quote via Phone

Calling Farmers directly allows you to speak with a representative who can guide you through the quoting process. This method is beneficial for those who prefer a more personal approach and might need assistance understanding the various coverage options. However, it may take longer than using the website. Expect to provide the same information as you would online.

Obtaining a Quote via a Local Agent

Working with a local Farmers agent provides a highly personalized experience. Agents can answer questions, explain coverage options in detail, and tailor a policy to your specific needs. This method is ideal for those who value face-to-face interaction and prefer a more comprehensive consultation. However, it requires scheduling an appointment and may not be as convenient as the other methods.

Discounts and Savings

Saving money on your car insurance is a top priority for most people. Farmers Insurance offers a variety of discounts to help you lower your premiums and keep more money in your pocket. By understanding these discounts and how to qualify for them, you can significantly reduce the overall cost of your coverage. This section will detail the most common discounts available and explain how to maximize your savings potential.

Farmers Insurance offers several valuable discounts designed to reward safe driving habits and responsible behavior. These discounts can substantially reduce your premium, making insurance more affordable. Understanding the eligibility criteria for each discount is crucial to maximizing your savings.

Safe Driver Discount, Car insurance quote farmers

This discount rewards drivers with clean driving records. Generally, drivers who have not been involved in accidents or received traffic violations within a specified period (often three to five years) are eligible. The specific criteria and discount percentage may vary by state and individual policy. For example, a driver with a spotless record for five years might receive a 15% discount, while someone with a single minor infraction might receive a smaller discount, perhaps 5%. The longer your clean driving history, the greater the potential savings.

Good Student Discount

Farmers Insurance recognizes the responsibility and maturity demonstrated by good students. High school and college students maintaining a certain grade point average (GPA) typically qualify for this discount. The required GPA and the discount percentage vary depending on the specific policy and state regulations. A student maintaining a 3.0 GPA or higher might receive a 10% discount, while a student with a 3.5 GPA or higher might qualify for a larger discount. This is a fantastic way for responsible students to save money on their car insurance.

Multi-Car Discount

Insuring multiple vehicles under a single Farmers Insurance policy often leads to significant savings. This discount reflects the reduced risk associated with insuring multiple cars from the same household. The discount percentage increases with each additional vehicle insured, providing substantial savings for families with multiple drivers and cars. For instance, insuring two cars might yield a 10% discount per vehicle, while insuring three cars could result at a 15% discount per vehicle.

List of Potential Discounts and Eligibility Criteria

It’s important to note that the availability and specific details of discounts can vary by state and individual policy. Contact your local Farmers Insurance agent for the most accurate and up-to-date information.

Below is a list of some potential discounts, though this is not exhaustive:

- Safe Driver Discount: Clean driving record for a specified period (typically 3-5 years) with no accidents or major traffic violations.

- Good Student Discount: High school or college student maintaining a specific GPA (usually 3.0 or higher).

- Multi-Car Discount: Insuring two or more vehicles under the same policy.

- Defensive Driving Course Discount: Completion of an approved defensive driving course.

- Homeowner’s Discount: Bundling home and auto insurance.

- Paperless Billing Discount: Opting for electronic billing and communication.

- Pay-in-Full Discount: Paying your premium in full upfront.

- Vehicle Safety Feature Discount: Having certain safety features installed in your vehicle, such as anti-theft devices or airbags.

Remember to always contact your Farmers Insurance agent to confirm your eligibility for specific discounts and to get the most accurate quote.

Comparison with Competitors

Choosing car insurance can feel overwhelming, with numerous companies offering a variety of plans. To help you make an informed decision, let’s compare Farmers Insurance with two other major players in the market: State Farm and Geico. This comparison will highlight key features, average pricing, and customer satisfaction to provide a clearer picture of your options.

Farmers Insurance, State Farm, and Geico each offer a range of coverage options and discounts, but their strengths and weaknesses vary. Understanding these differences is crucial for selecting the policy that best suits your individual needs and budget. Consider factors like your driving history, the type of vehicle you drive, and your location when evaluating these options.

Key Features and Pricing Comparison

The following table summarizes key features and average quote prices for car insurance from Farmers, State Farm, and Geico. Note that average quote prices can fluctuate significantly based on individual circumstances. These figures are estimates based on industry data and should be considered illustrative rather than definitive. Customer ratings represent an aggregated score from multiple reputable review sites.

| Insurer | Key Features | Average Quote Price (Annual) | Customer Ratings (out of 5 stars) |

|---|---|---|---|

| Farmers | Wide range of coverage options, strong roadside assistance, discounts for bundling, good customer service reputation in some areas. | $1200 | 4.0 |

| State Farm | Extensive network of agents, strong reputation for claims handling, various discounts available, wide range of coverage options. | $1150 | 4.2 |

| Geico | Competitive pricing, easy online quote process, strong focus on digital tools and services, often features lower premiums for good drivers. | $1000 | 4.1 |

Advantages and Disadvantages of Choosing Farmers

Farmers Insurance offers several advantages. Their extensive network of agents provides personalized service and assistance, which can be particularly beneficial for those who prefer in-person interactions. They also often offer a wide range of coverage options, catering to diverse needs. However, Farmers’ pricing might not always be the most competitive compared to online-focused insurers like Geico. Customer service experiences can vary significantly by location and agent.

Securing the best car insurance quote from Farmers, or any provider, requires careful consideration of your individual needs and driving profile. By understanding the factors that influence pricing, comparing available coverage options, and taking advantage of potential discounts, you can significantly reduce your costs and ensure you have the appropriate protection. Remember to thoroughly review your policy documents and utilize available customer service channels for any questions or concerns.

Getting a car insurance quote from Farmers is a common starting point for many drivers. However, comparing rates is key to finding the best deal, and you might want to check out other options like a safe auto car insurance quote to see how their prices stack up. Ultimately, securing the most competitive car insurance quote from Farmers or any other provider requires careful comparison shopping.

Farmers Insurance offers competitive car insurance quotes, but comparing rates is always a good idea. To easily find the best coverage for your needs, you can quickly and conveniently get online quote for car insurance from multiple providers. This allows you to compare Farmers’ quotes with others before making a decision, ensuring you get the best value for your car insurance.

Remember to factor in all relevant details when requesting your Farmers quote.

Post a Comment